Studying in the USA is a dream for many Indian students, offering world-class education, unparalleled research opportunities, and exposure to global cultures. However, the journey comes with its share of financial challenges that can be daunting. Let’s explore the major financial hurdles and how students can overcome them.

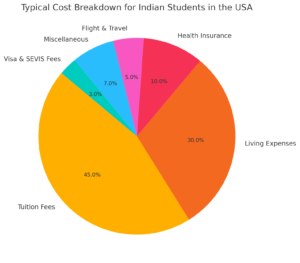

1. Tuition Fees

One of the biggest expenses for international students is tuition. On average, tuition for undergraduate programs in the USA ranges from $20,000 to $50,000 per year, while graduate programs can cost between $25,000 and $40,000 annually.

Solution:

- Explore scholarships, grants, and assistantships.

- Apply for public universities, which often have lower tuition fees than private institutions.

2. Living Expenses

The cost of living in the USA varies significantly based on location. Metropolitan cities like New York, Los Angeles, or San Francisco have high living costs, with monthly expenses averaging $1,500 to $2,500. Smaller cities or towns may cost around $800 to $1,200 per month.

Key Costs:

- Accommodation: Rent takes up a significant portion of the budget.

- Groceries and Utilities: Approximately $300 to $600 per month.

- Transportation: Public transit or personal vehicles can add $100 to $200 monthly.

Solution:

- Share accommodations with fellow students.

- Opt for part-time jobs on-campus to cover daily expenses.

3. Flight and Travel Costs

Traveling from India to the USA can be expensive, with flight tickets costing anywhere from ₹50,000 to ₹1,00,000 depending on the season and booking time. Additionally, students often need to travel back and forth for holidays or emergencies.

Solution:

- Book tickets in advance.

- Use student discounts and consider budget airlines.

4. Visa and SEVIS Fees

The student visa process involves significant costs:

- F1 Visa Fee: $160 (~₹13,000)

- SEVIS Fee: $350 (~₹28,000)

These fees, coupled with costs for attending visa interviews and additional documentation, can add up.

Solution:

- Ensure all documentation is accurate to avoid delays and extra fees.

- Seek guidance from professional visa consultants.

5. Health Insurance

Health insurance is mandatory for international students in the USA, with annual premiums ranging between $1,200 to $3,000. Medical care without insurance can lead to exorbitant bills.

Solution:

- Choose university-provided health insurance plans, often negotiated at a lower group rate.

- Compare private health insurance plans tailored for international students.

6. Hidden Costs

Students often underestimate smaller but recurring expenses such as:

- Textbooks and Study Materials: Can cost $500 to $1,000 annually.

- Application Fees: Applying to multiple universities can cost $50 to $100 per application.

- Miscellaneous Expenses: Includes recreation, emergencies, and unforeseen events.

Solution:

- Opt for used or digital textbooks.

- Budget for contingencies.

7. Loan Repayments

Many students rely on education loans to finance their studies. However, the repayment process post-graduation can be overwhelming, especially with fluctuating interest rates and the limited grace period.

Solution:

- Choose loans with flexible repayment terms.

- Utilize the STEM OPT extension to maximize employment opportunities and earnings.

8. Fluctuating Exchange Rates

The rupee-dollar exchange rate can significantly impact overall costs. Any depreciation in the rupee increases the financial burden.

Solution:

- Maintain funds in USD to hedge against currency fluctuations.

- Use specialized forex cards or remittance services for better rates.

Overcoming Financial Hurdles: A Strategic Approach

Navigating these financial hurdles requires meticulous planning, research, and proactive steps. Here’s a quick checklist for aspiring students:

- Start planning early and create a detailed budget.

- Research and apply for every possible scholarship and grant.

- Seek part-time job opportunities to earn while studying.

- Consult reliable resources and expert advisors for guidance.

For tailored career and financial counseling, visit Patsons Career, a trusted partner in helping students achieve their dreams abroad.